unemployment tax refund 2021 tracker

1304 ET Sep 24 2021. What are the unemployment tax refunds.

Irs Unemployment Refund Update How To Track And Check Its State As Com

WHILE there are 436000 returns are still stuck in the IRS system Americans are looking for ways to track their unemployment tax refund.

. This tax break was applicable. 2020 income tax refund using the IRS tracker. During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes.

The IRS announced o n March 31 2021 that the funds will be refunded by the IRS during the spring and summer of 2021 to taxpayers who filed their tax return reporting unemployment compensation on or before March 15 2021. Usually you never have to pay back unemployment except in these weird cases during these weird pandemic times where states are sending letters to some workers saying that theyve been overpaid. Do you have to pay unemployment back.

HOUSEHOLDS waiting for unemployment tax refunds will be unhappy to know that 436000 returns are still stuck in the IRS system. Ad See How Long It Could Take Your 2021 State Tax Refund. They fully paid and paid their state unemployment taxes on time.

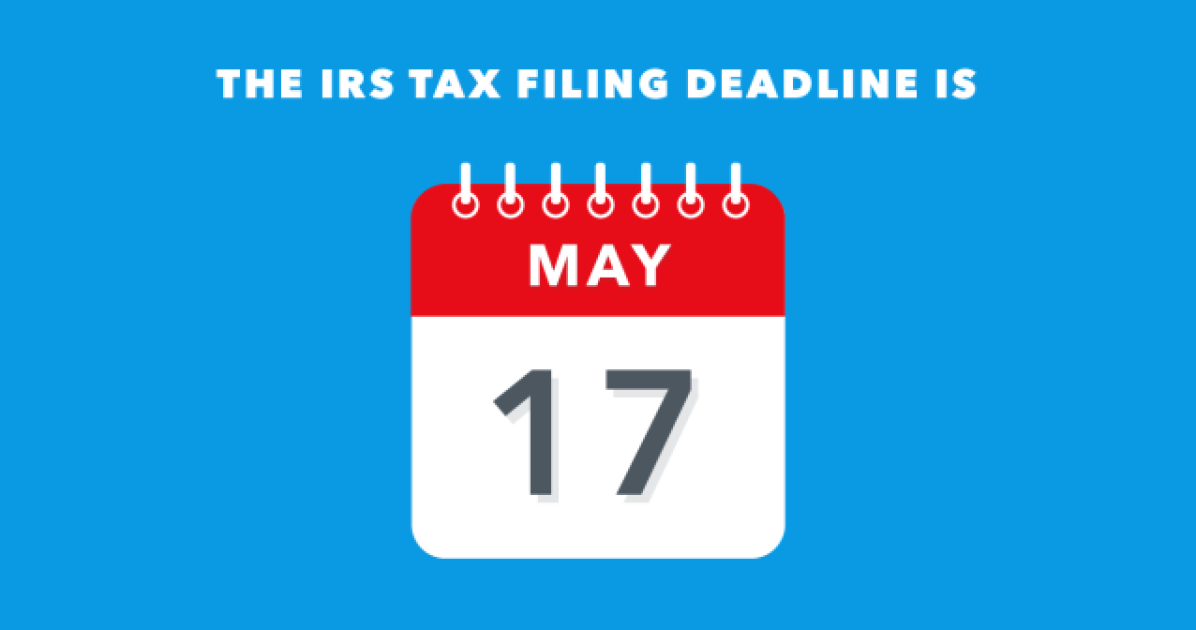

The IRS has been sending out unemployment tax refunds since May. Unemployment tax refund 2021 tracker Friday March 11 2022 Edit. For the latest information on IRS refund processing see the IRS Operations Status page.

Check your refund status online 247. Tax Refund Timeline Here S When To Expect Yours What You Need To Know About Unemployment Tax Refund Irs Payment Schedule And More Where S My. Luckily the millions of people who are.

TOP will deduct 1000 from your tax refund and send it to the correct government agency. Its taking more than 21 days for IRS to issue refunds for certain mailed and e-filed 2020 tax returns that require review And in some cases this work could take 90 to 120 days. Heres an example.

Or a refund due to March legislation on tax-free unemployment. CNBC Tax season is here. 1222 PM on Nov 12 2021 CST.

After entering the below information you will also have the option of being notified by text or e-mail when the status of your tax return changes. 2021 Tax Refund Status In 2022. See Refund amount requested to learn how to locate this amount.

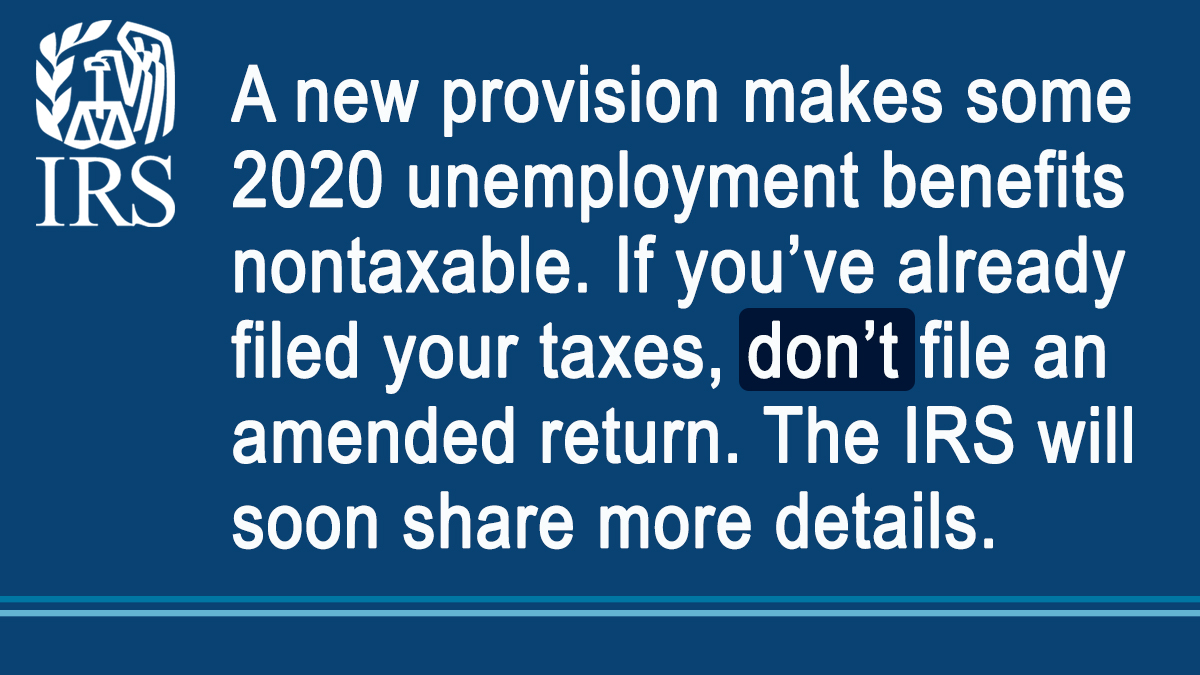

You were going to receive a 1500 federal tax refund. The American Rescue Plan Act which was signed on March 11 included a 10200 tax exemption for 2020 unemployment benefits. Do we need to file an amended return or pay back all or some of the refund we received.

1222 PM on Nov 12 2021 CST. CNBC Unemployment tax refunds may be seized for unpaid debt and taxes May 18 2021. 2224 ET Sep 26 2021.

Added January 7 2022 A10. Select the tax year for the refund status you want to check. Enter the amount of the New York State refund you requested.

Your employer on the other hand may be eligible for a credit of up to 54 of FUTA taxable wages if. May 31 2021 135 PM. This system provides information regarding the status of your Missouri tax return.

We received a notice stating the IRS corrected our return to allow the unemployment compensation exclusion but we believe the exclusion amount is too much. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes.

Enter your Social Security number. Unemployment Tax Refunds May Not Arrive Until Next Year Warns Irs Available only on IRSgov. Qualifying Americans will receive 300 per week on top of state unemployment benefits through Sept.

The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. Enter the following four items. Choose the form you filed from the drop-down menu.

Waiting For Your Unemployment Tax Refund About 436000 Returns Are Stuck In The Irs System. But you are delinquent on a student loan and have 1000 outstanding. 2021 tax refund delay.

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in 2020. 1951 ET Sep 26 2021. If your unemployment tax refund hasnt come you might be wondering when you ll get it.

In its latest update the tax agency said it had released more than 10 billion in jobless tax refunds to nearly 9. You may only view the status of 2018 or later year returns. Learn How Long It Could Take Your 2021 State Tax Refund.

The latest on the IRS backlog and how to track your money. It will also send you a notice of its action along with the remaining 500 that was due to you as a tax refund. From 2021 the FUTA tax rate is 60 and it applies to the first 7000 in annual wages paid per employee.

Any updates on how to track the IRS unemployment tax refund. Unemployment benefits count as taxable income the unemployment income federal tax exemption does not include unemployment income for 2021If you didnt have tax withheld from their unemployment payments or didnt have enough withheld in 2021 you may owe money to the IRS or get a smaller-than-expected tax refund. Dont expect a refund for unemployment benefits Jan.

The exemption which applied to federal taxes meant that unemployment checks sent during the pandemic werent counted as earned income. The IRS moved quickly to implement the provisions of the American Recovery. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the unemployment tax break.

There is no way to track this since the department who has been tasked with this and all the other unusual situations this year are overwhelmed by millions of returns in a department only set up to process thousands of returns per year.

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Irsnews On Twitter If You Received Unemployment Benefits Last Year And Already Filed Your 2020 Tax Return Don T File An Amended Return Irs Will Be Issuing Guidance To Address Changes Brought By

![]()

What You Need To Know About Unemployment Tax Refund Irs Payment Schedule And More

Over 7 Million Americans Could Receive Refund For 10 200 Unemployment Tax Break

Where S My Refund Home Facebook

Self Employed Tax Preparation Printables Instant Download Etsy In 2021 Tax Preparation Tax Checklist Tax Prep Checklist

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Waiting For Your Unemployment Tax Refund About 436 000 Returns Are Stuck In The Irs System

Tax Refund Timeline Here S When To Expect Yours

430 000 People To Receive Unemployment Benefit Tax Refunds From Irs Wfla

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Com

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

Tax Refund Timeline Here S When To Expect Yours

Irs Tax Law Change Will Trigger Wave Of Refunds Wwlp

Where S Your Tax Refund How To Track Irs Money Straight To Your Bank Account Cnet